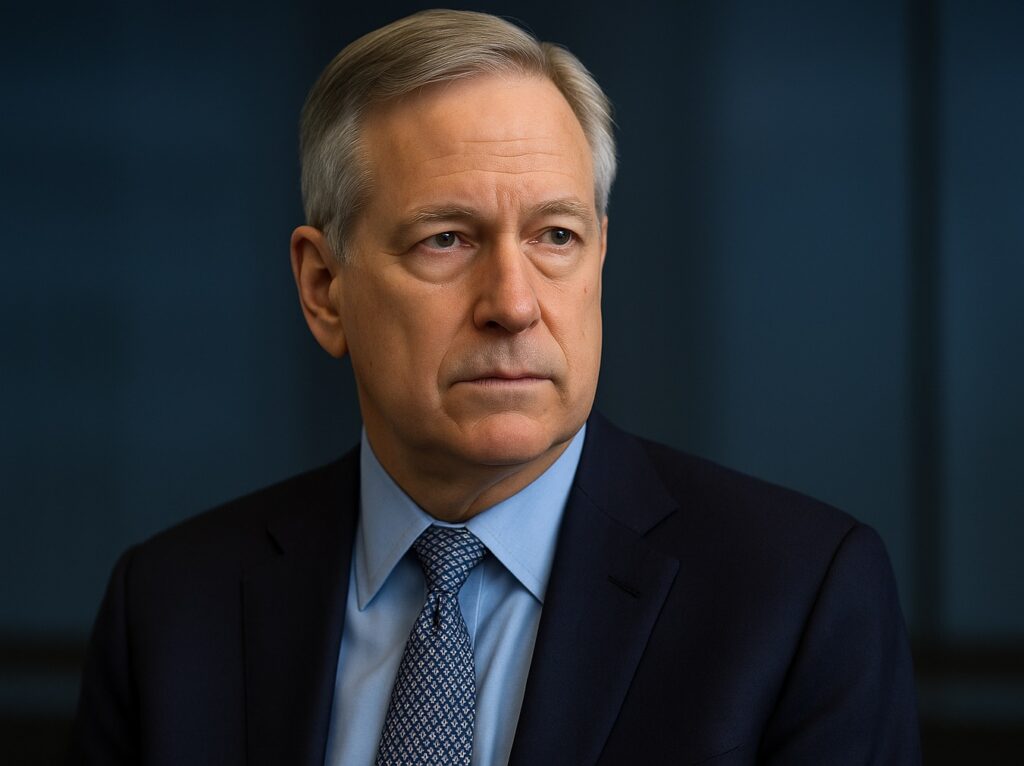

After a distinguished career spanning over three decades, the chief strategist at Goldman Sachs has officially announced his retirement. His departure marks the end of an era for one of Wall Street’s most influential voices in market strategy and analysis. In his final public statements, the strategist issued a cautionary note about a potential bubble forming in today’s financial markets, urging investors and policymakers to exercise vigilance.

Related: The 100 Best Albums of 2025 – Rolling Stone

Related: US Institute of Peace Renamed for Trump After His Administration Reshaped It

Related: Multiple Afghans Arrested by ICE in Albany Amid Crackdown After D.C. Shooting

Background: A Career of Market Insight

Having served as Goldman Sachs’ chief strategist for 31 years, this individual’s work has shaped market perspectives and investor behavior across multiple economic cycles. Throughout his tenure, he has been renowned for his rigorous analysis, blending macroeconomic trends with technical market signals to forecast shifts in equities, fixed income, and global assets. His influence extended beyond Goldman Sachs, often cited in financial media and sought after by institutional investors worldwide.

His retirement comes at a pivotal moment when markets are navigating unprecedented levels of uncertainty and volatility. The strategist’s final warnings provide critical context for understanding current market dynamics.

Identifying the Current Market Bubble

In his recent remarks, the strategist pointed to several indicators suggesting that certain asset classes are exhibiting characteristics of a bubble. While avoiding specific asset names, he described conditions marked by excessive valuations, speculative investor behavior, and divergence from underlying economic fundamentals.

Key factors cited include:

- Elevated Valuations: Equity markets are trading at price-to-earnings ratios significantly above historical averages, raising concerns about sustainability.

- Investor Sentiment: There is widespread exuberance, with retail and institutional investors increasingly chasing high-growth and speculative assets.

- Liquidity Conditions: While monetary policy has been tightening in many regions, prior years of accommodative policies have left abundant liquidity, potentially inflating asset prices.

- Market Concentration: A narrowing of market leadership into a handful of sectors and companies, which amplifies systemic risk if sentiment shifts.

These patterns, he argues, mirror previous bubbles in history, though each bubble has unique catalysts and manifestations.

Contextualizing Market Conditions in the Current Year

The strategist’s observations come in the context of a financial environment shaped by several intersecting trends:

- Monetary Policy Shifts: Central banks around the world have been transitioning from ultra-loose policies to more normalized stances, leading to higher interest rates and tighter liquidity.

- Geopolitical Tensions: Ongoing conflicts and trade uncertainties are contributing to increased market volatility and economic unpredictability.

- Technological Disruption: Rapid advancements in technology sectors continue to fuel investor enthusiasm but also raise questions about valuations and long-term profitability.

- Inflationary Pressures: Persistent inflation in various economies is impacting consumer behavior, corporate earnings, and investment strategies.

These factors create a complex backdrop against which the strategist warns of bubble risk, emphasizing that investors should be mindful of potential corrections.

Implications for Investors and Policymakers

The strategist’s warning is particularly relevant for a broad range of stakeholders:

- Individual Investors: Those heavily invested in growth-oriented or speculative assets should consider portfolio diversification and risk management strategies to mitigate potential losses.

- Institutional Investors: Pension funds, mutual funds, and hedge funds may need to reassess exposure to overvalued sectors and incorporate stress testing aligned with bubble scenarios.

- Regulators and Policymakers: Monitoring systemic risks and implementing macroprudential measures could be vital to prevent destabilizing market corrections.

- Financial Advisors: Providing clients with balanced perspectives on current market exuberance and cautionary advice will be critical.

In addition, the strategist highlights the importance of maintaining a long-term investment horizon and avoiding reactionary decisions driven by short-term market movements.

Expert Insights: Industry Perspectives on Bubble Risk

Market experts across the financial sector echo the retiring strategist’s concerns, noting several parallels with historical bubbles, yet also acknowledging the unique features of today’s environment.

- Valuation Metrics: Analysts point out that while some sectors exhibit stretched valuations, others remain fairly priced, suggesting that a broad-based bubble might be less likely than sector-specific overheating.

- Investor Behavior: Behavioral economists highlight that retail participation has increased significantly, driven by technology platforms and social media, which can accelerate speculative trends.

- Monetary Policy Impact: Some experts argue that ongoing tightening measures may help deflate bubbles gradually rather than causing abrupt market crashes.

- Technological Innovation: Analysts stress that rapid innovation can justify higher valuations to some extent, though fundamentals ultimately govern sustainability.

These insights underscore the complexity of identifying and managing bubble risk in today’s multifaceted market landscape.

Looking Ahead: Navigating Market Uncertainty

As the strategist steps down, his final counsel serves as a reminder of the cyclical nature of markets and the importance of vigilance. Looking ahead, investors should consider several strategies to navigate ongoing uncertainties:

- Diversification: Broadening asset allocation across sectors, geographies, and asset classes can reduce exposure to any one bubble-prone area.

- Risk Management: Employing hedging techniques and regular portfolio reviews can help manage downside risks.

- Research and Due Diligence: Staying informed on economic indicators, corporate earnings, and market sentiment is critical for timely decision-making.

- Long-Term Focus: Prioritizing investment objectives and avoiding reactionary moves to short-term volatility can enhance resilience.

Policymakers will also need to balance supporting economic growth while mitigating financial excesses that could threaten stability.

Conclusion

The retirement of Goldman Sachs’ chief strategist after 31 years marks a significant moment in market analysis and strategy. His cautionary statements about a potential bubble in today’s markets carry weight, given his extensive experience navigating multiple market cycles. While the current financial environment is marked by elevated valuations, shifting monetary policies, and geopolitical uncertainties, the strategist’s insights emphasize the need for careful analysis, disciplined investing, and prudent risk management.

Investors and policymakers alike should heed these warnings and prepare for possible market corrections while recognizing the unique opportunities and challenges of the current landscape. Maintaining a balanced, informed approach will be crucial to navigating the evolving market dynamics in the year ahead.